Top Notch Tips About How To Build Credit When You Have Bad Credit

Secured chime credit builder visa® credit card issued by stride bank n.a., member fdic.

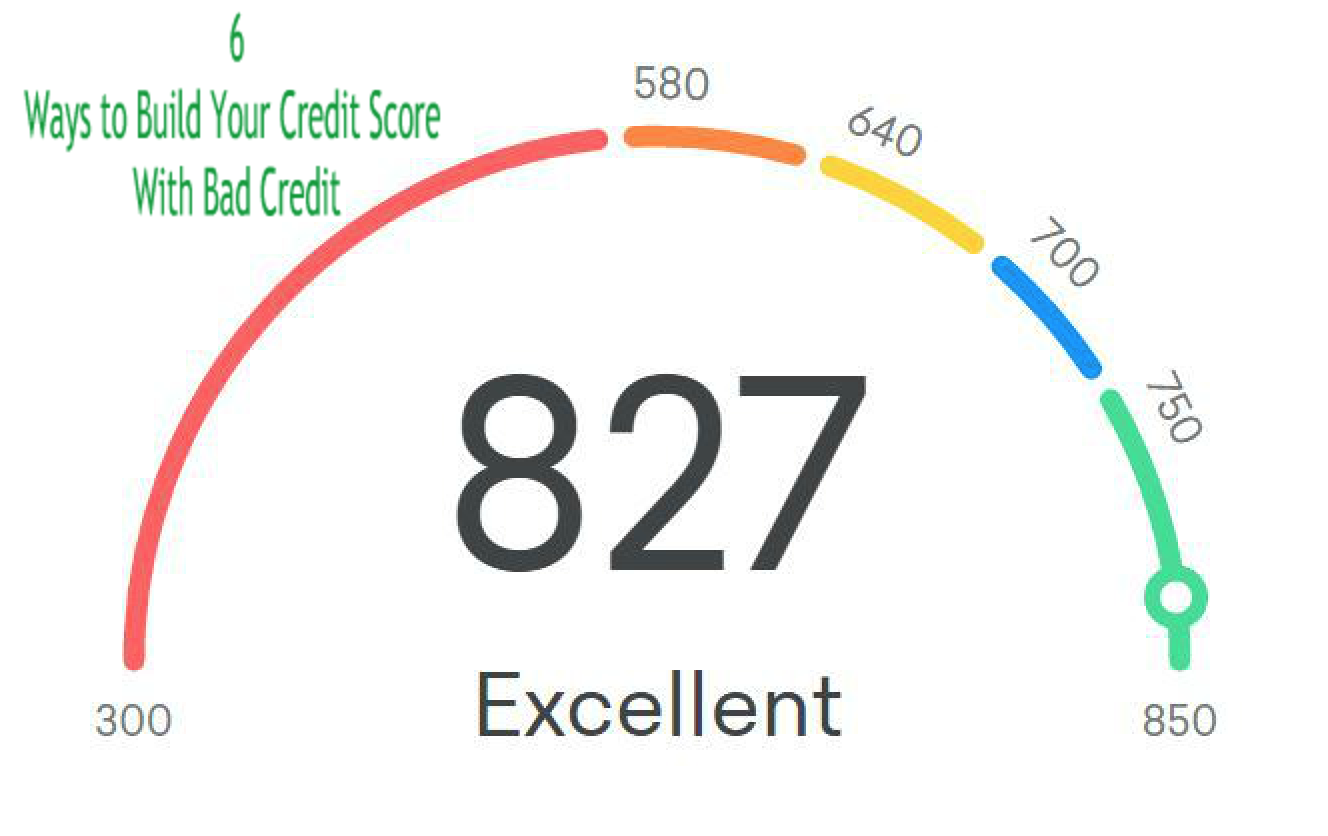

How to build credit when you have bad credit. For others, it could take six months to a year. Ad responsible card use may help you build up fair or average credit. If your bank turned down your application for a traditional credit card but offered you a secured card instead, that can be a.

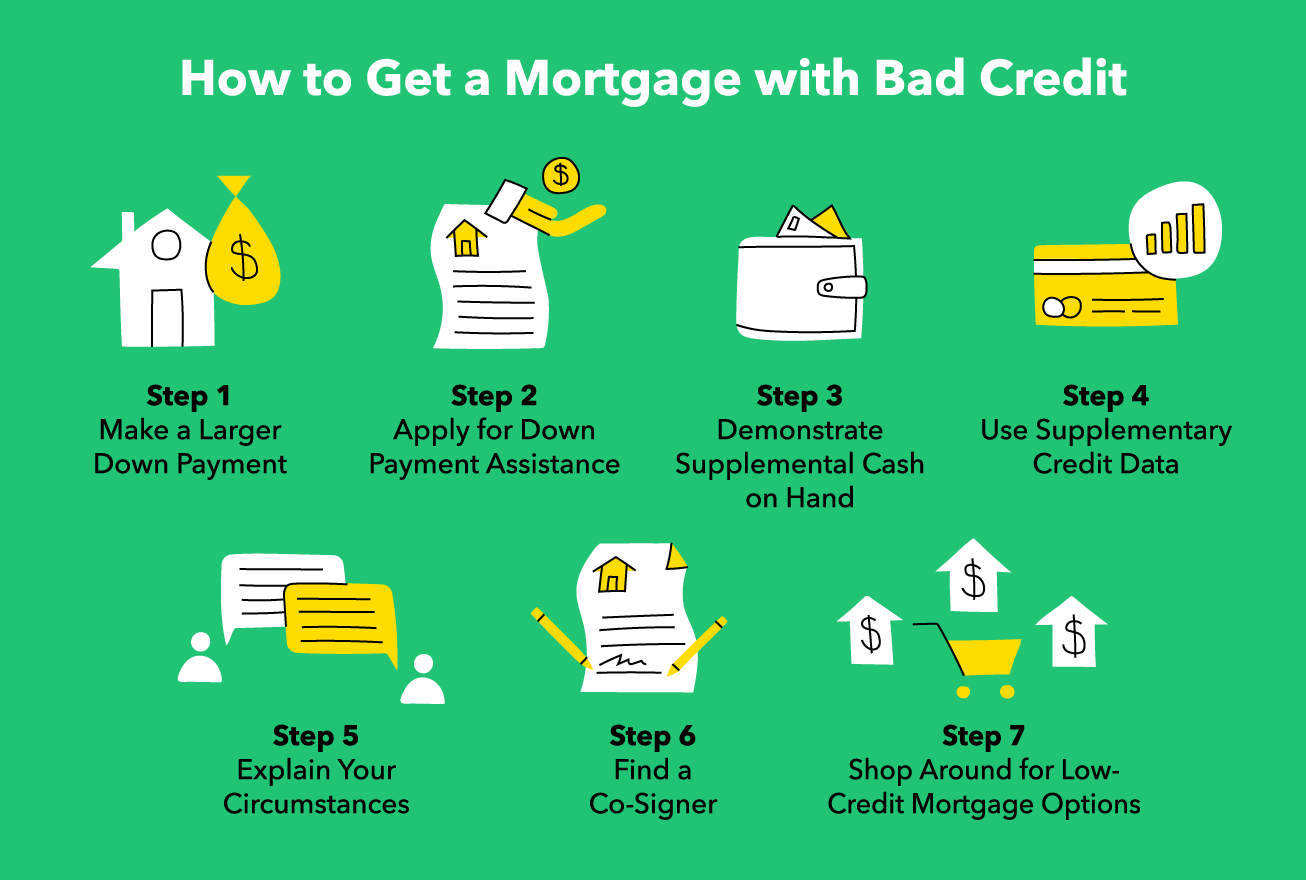

Most places offer online applications that are easy to fill out. A low credit score doesn't have to follow you forever. New credit scores take effect immediately.

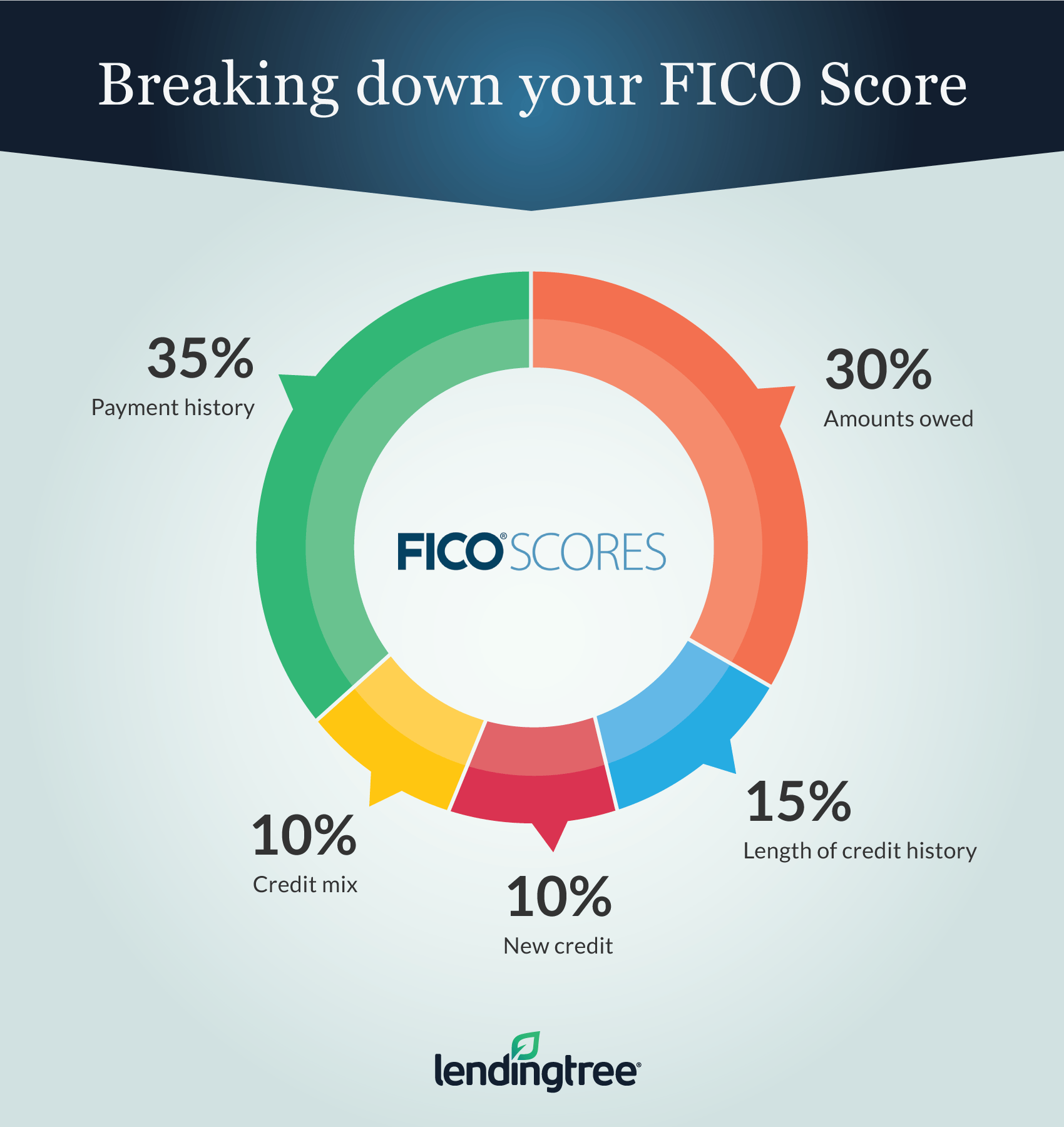

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. Adopt positive habits to build credit once you get a credit card—whether it's a secured card, a retail card, or you're an authorized user on someone else's card—it's important. The issuer will usually ask for a deposit between.

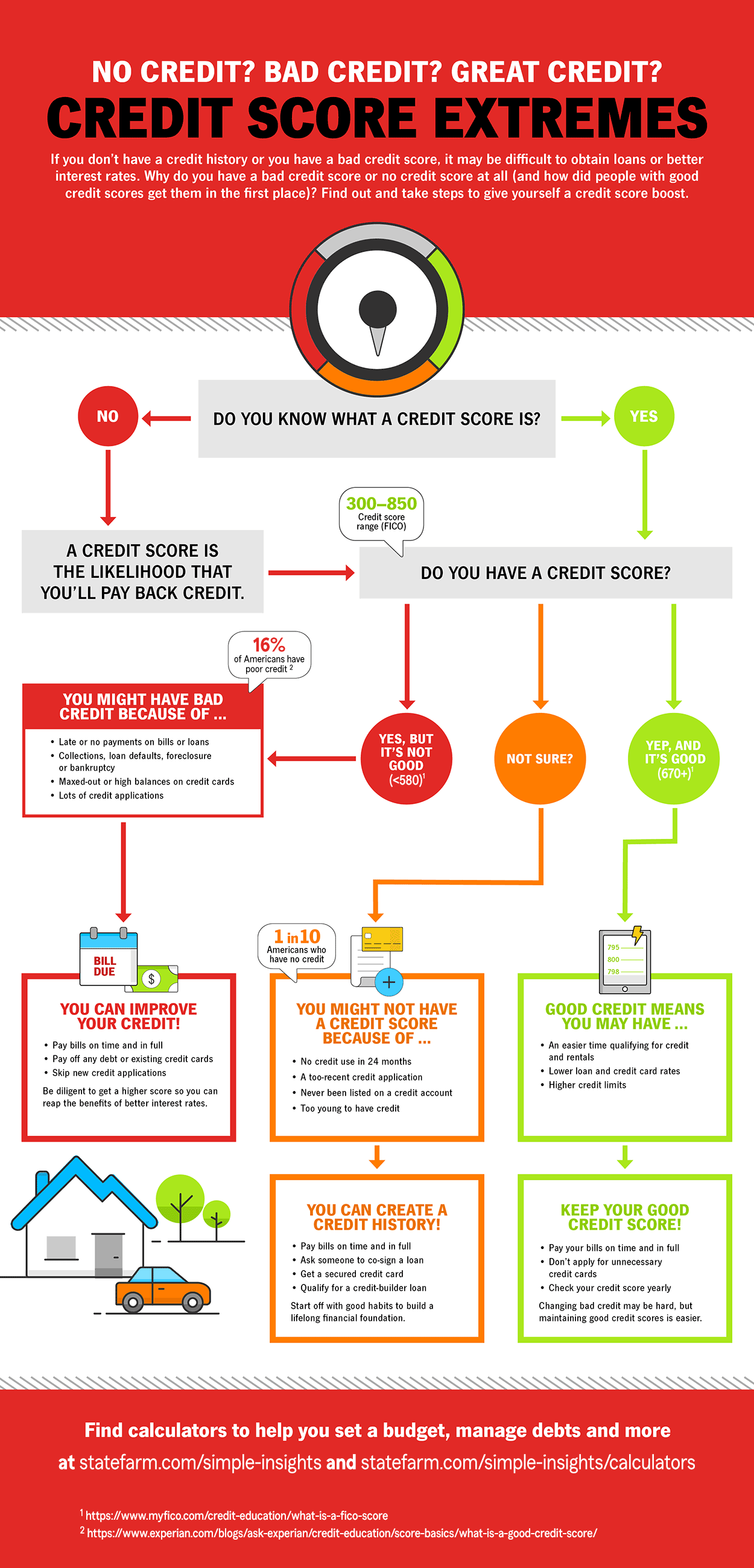

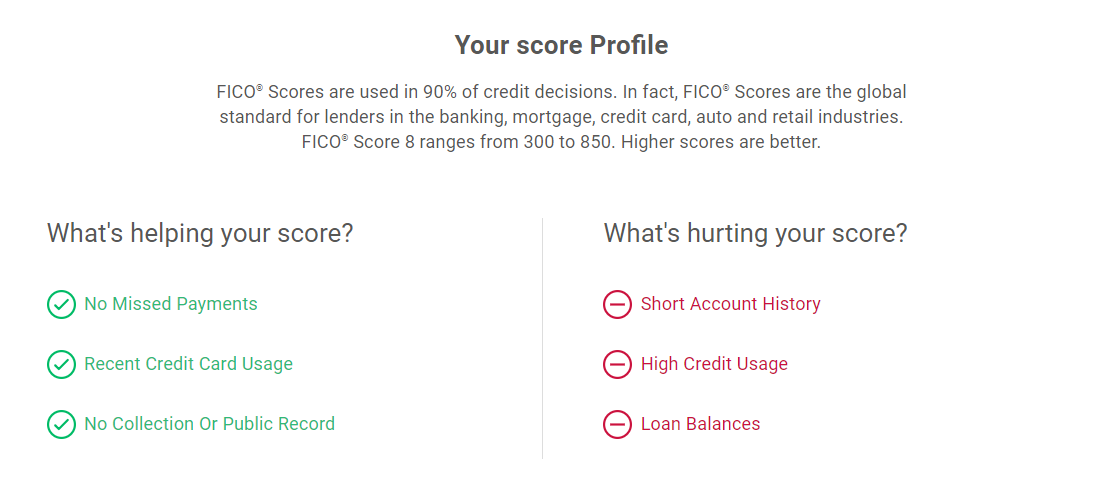

Ad build your credit with credit builder visa® credit card. Ad you can increase your fico® score for free. If you’re ready to work toward rebuilding your credit, the four steps below can walk you through the process.

The lower our score, the more likely we are to pay more for everything from credit card interest to. Some of the best ways to strengthen your personal credit include: Find the right one for your unique needs.

Try a small working capital loan. However, building a credit score is about responsible credit usage and positively impacting the. 18 hours agotitle i property improvement loan.

/Balance_How_To_Rebuild_Bad_Credit_960374_V2-7b70a07f737c4a3ea7e4dce641d3049d.png)