Brilliant Strategies Of Tips About How To Improve Debt Ratio

Pursuing refinancing may also allow you to lower your monthly payments which will.

How to improve debt ratio. How to improve your dti? Reduce your monthly debt payments, and increase your income. The lower the ratio, the better.

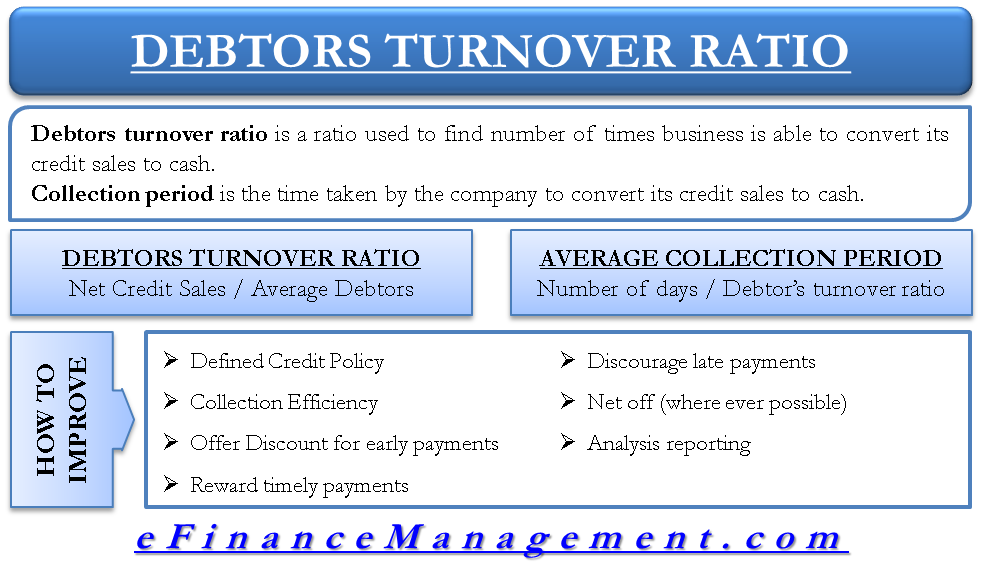

Strategies that can be used include increasing profitability, better inventory management, and debt. How to improve your debt service coverage ratio (dscr) cost management, expense reduction insights. Negotiate raw material prices any reduction in expenses can increase the profit after tax and thereby have an increasing effect on dscr.

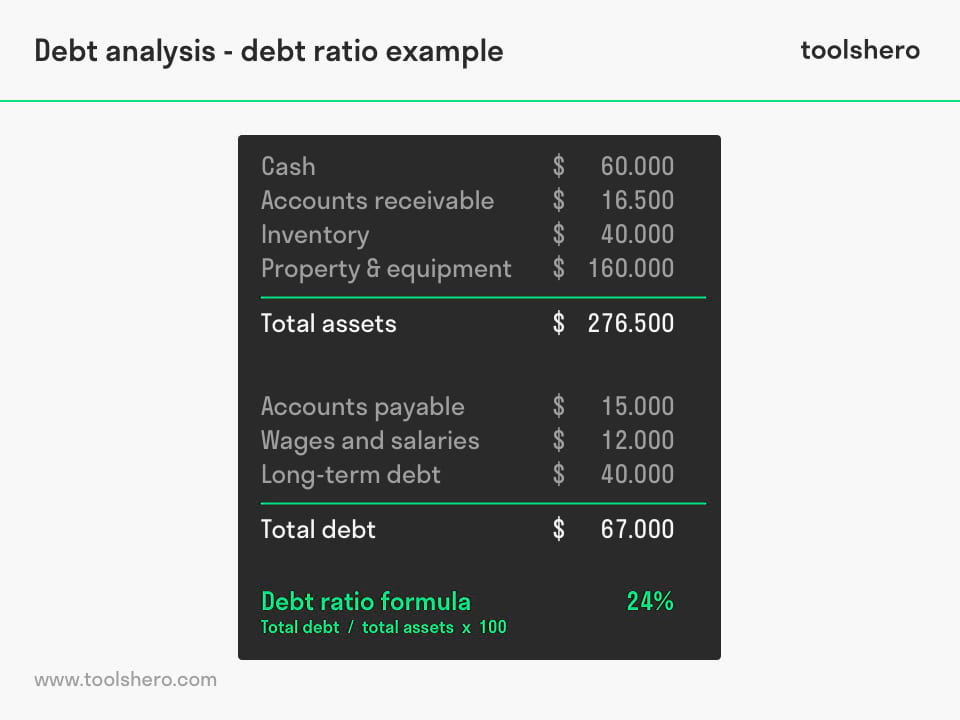

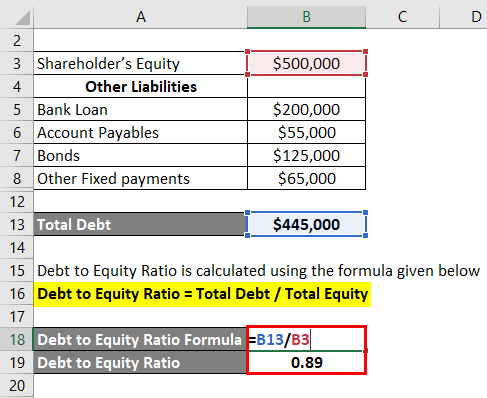

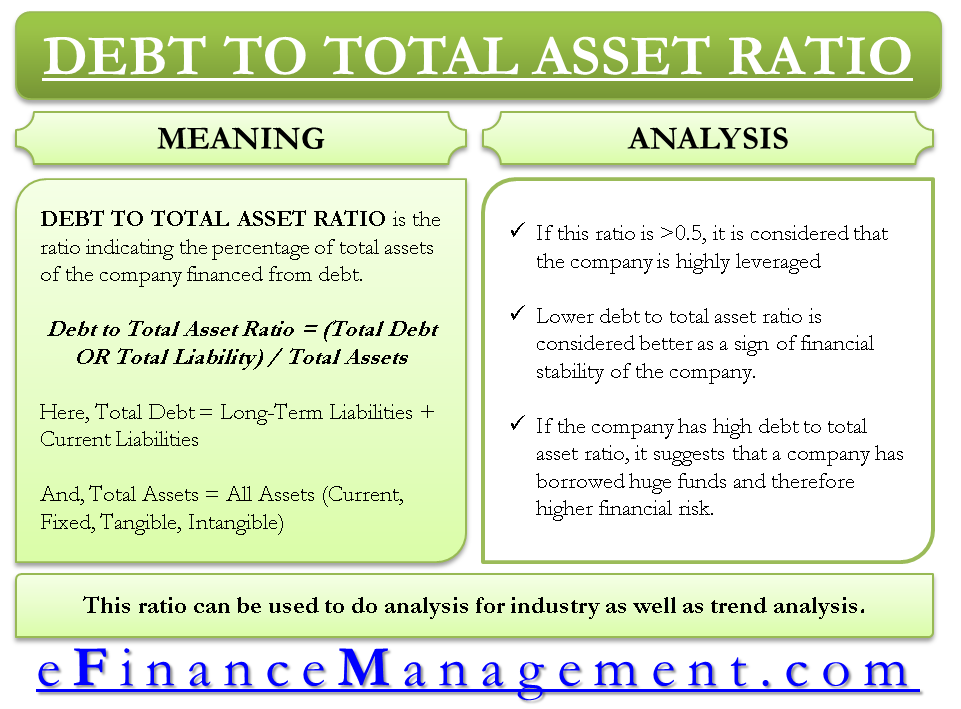

Then, divide that number by your gross monthly income. You can start by adding up your monthly debt payments, including credit cards and loans. Controlling the inventories more efficiently is another step that can be taken to reduce the debt to total assets ratio.

The organization can rely heavily on. If you’re using more than 50% of your monthly income to pay. Your final step could be deciding to get a slightly lower mortgage, dropping your monthly payment to.

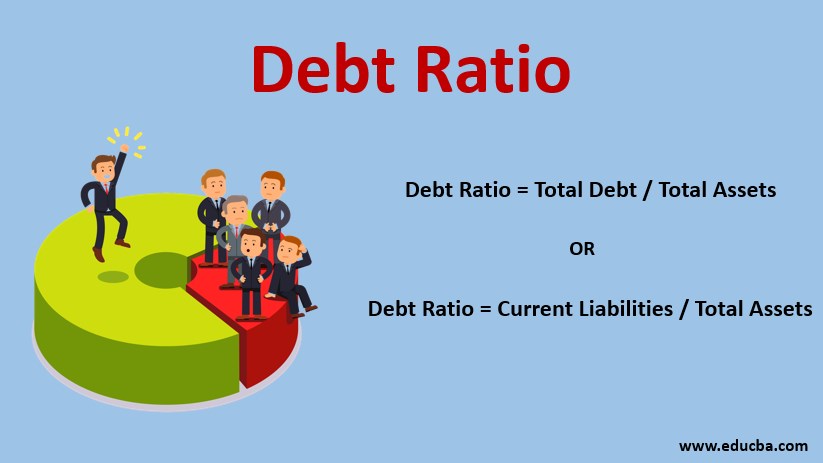

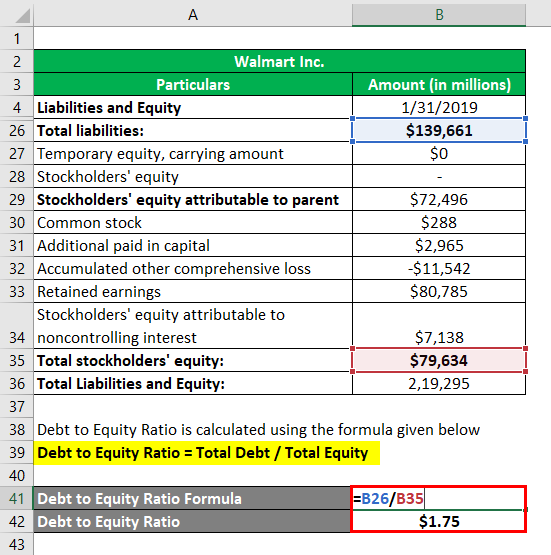

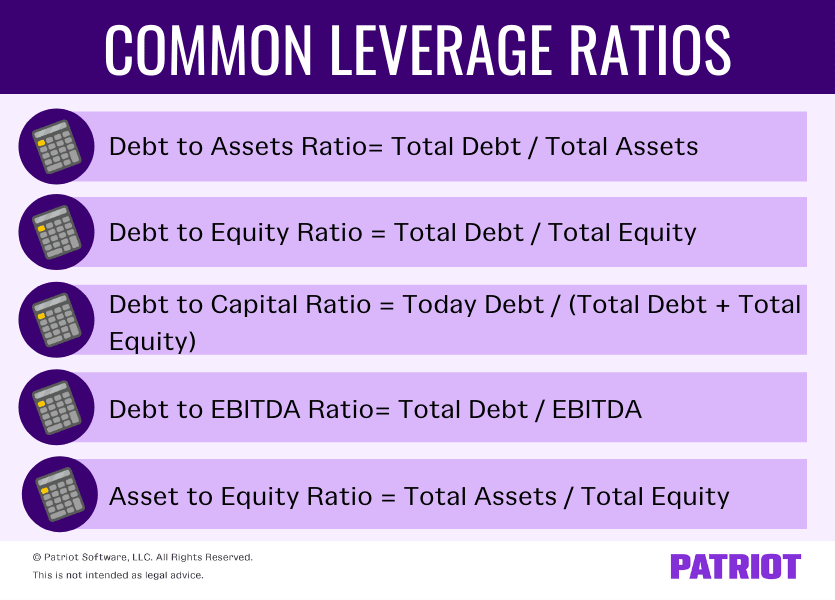

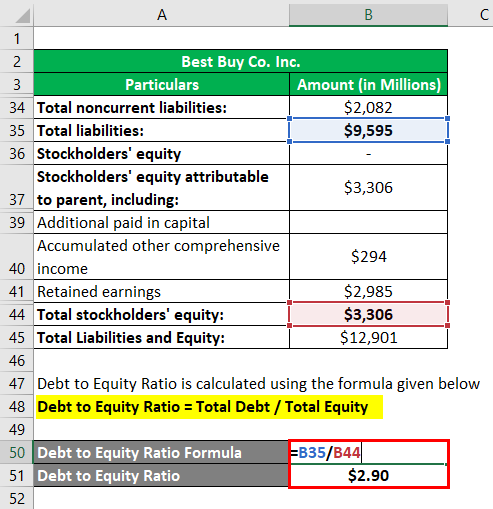

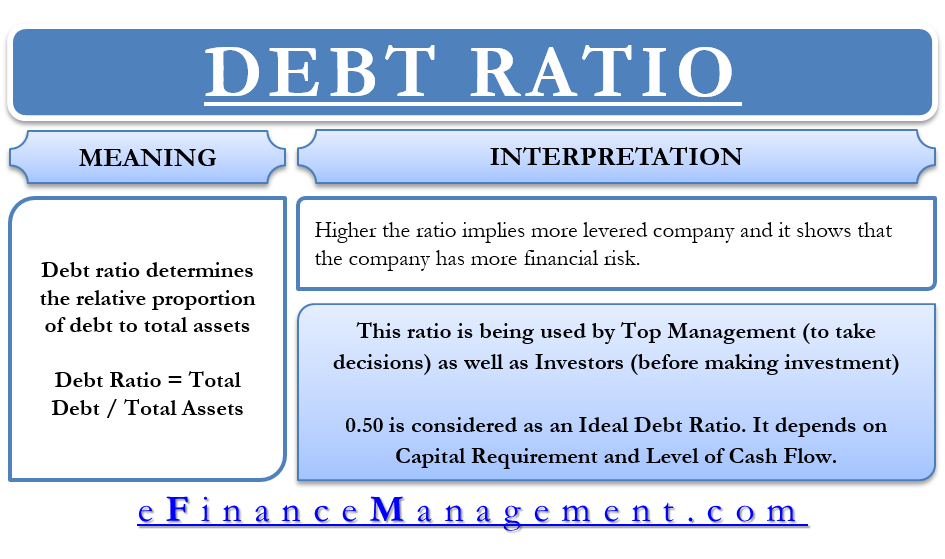

The debt ratio is defined as the ratio of total debt to total assets,. Using less of your available credit looks better on your report. The debt ratio is a financial ratio that measures the extent of a company’s leverage.

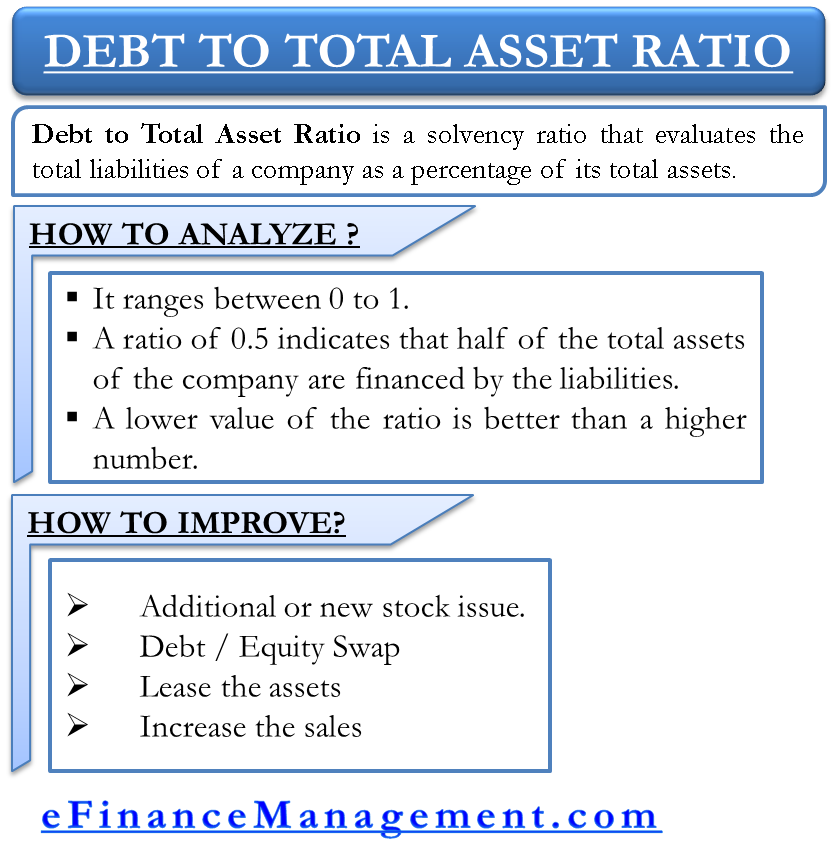

One option is to refinance if you qualify for a lower interest rate or can change your repayment terms. If you’re considering expanding your business, purchasing new equipment, or adding a. Ways to improve the debt to asset ratio of a company.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)